Chartered Accountant Noida& Delhi NCR | GST & Tax Services – Kunal Kapoor & Associates

CHARTERED ACCOUNTANTS IN NOIDA & DELHI NCR, INDIA

We are a Chartered Accountancy firm serving clients across Noida, Gurgaon, and Delhi, with strong expertise in GST, Income Tax, Startup compliance, and MSME taxation. Our practice focuses on delivering accurate, compliant, and business-oriented solutions tailored to entrepreneurs, startups, and growing businesses. Book a free consultation to understand how we can support your compliance and growth journey.

Chartered Accountant (CA) Services in Noida & Delhi NCR

Kunal Kapoor & Associates is a trusted CA in Noida providing end-to-end professional services in GST, Income Tax, Startup advisory, MSME compliance, audits, and regulatory matters across Noida and the Delhi NCR region. As an experienced Chartered Accountant firm, we focus on delivering accurate, timely, and practical solutions tailored to startups, SMEs, professionals, and growing businesses.

With a strong foundation in Indian tax and corporate laws, our Chartered Accountant team assists clients with GST registration and filings, Income Tax returns, tax planning, statutory and internal audits, and ongoing compliance management. As a reliable CA in Noida, we combine technical expertise with a client-centric approach, ensuring cost-efficient compliance and long-term value. Our mission as a Chartered Accountant firm is to support business growth while maintaining strict regulatory discipline and transparency.

OUR SERVICES

Audit & Assurance

Tax Audit

Statutory Audit

Internal Audit

Stock Audit

Fixed Assets Audit

Management Audit

Due Diligence

Goods & Service Tax

GST Consultancy Services

GST Audit

GST Litigation Services

GST Compliance Services

GST Refunds

GST Returns

GST Registration

Taxation & Compliance

Corporate Tax

Direct & Indirect Tax

Income Tax Return Filings

Certification and Attestation Services

Faceless Assessment under Income Tax

Lower Deduction Certificate

80G & 12A Registration

Income Tax Litigation Services

Business Registration

Trademark Registration

Import Export Code

Shops & Establishments

MSME Registration and Compliance

NGO/Trust/Society

Fssai Registration and Licensing

Startup India Registration

Niti Aayog Registration

International Taxation

NRI Taxation

Transfer Pricing

Double Taxation Avoidance Agreement

Taxation of Expats

Filing of Forms 15CA-15CB

Residential Status for NRIs

Tax Residency Certificate

Company & LLP Services

Company Registration

Company Annual Compliances

LLP Annual Filings

LLP Formations

FC-GPR and RBI Compliance

Foreign Company Setup in India

Company Strike Off and LLP Closure

Account Outsourcing & Book Keeping

Accounting and Book Keeping

Payroll Management

ABOUT US

Established in 2015, Kunal Kapoor & Associates is a firm of Chartered Accountants delivering comprehensive, reliable, and compliance-driven professional services to businesses, startups, and individuals. Over the years, the firm has built strong expertise across GST, Income-tax, Startup advisory, MSME taxation, statutory and internal audits, and end-to-end regulatory compliances, supported by a deep understanding of Indian laws and evolving regulatory frameworks.

Our practice is rooted in hands-on experience across diverse industry verticals, enabling us to offer practical, cost-efficient, and solution-oriented advice rather than purely theoretical inputs. We assist clients at every stage of their business lifecycle—from GST registration, tax planning, and return filings to startup structuring, MSME compliance, audits, assessments, and litigation support.

We place strong emphasis on accuracy, timelines, and regulatory discipline, ensuring that our clients remain fully compliant while optimising tax positions within the framework of law. Our approach combines professional rigour with personalised attention, helping us build long-term, trust-based relationships with entrepreneurs, promoters, and growing organisations.

At Kunal Kapoor & Associates, our objective is simple: to act as a dependable compliance and advisory partner, allowing our clients to focus on growth while we take care of their tax, audit, and compliance responsibilities.

FROM OUR BLOG

-

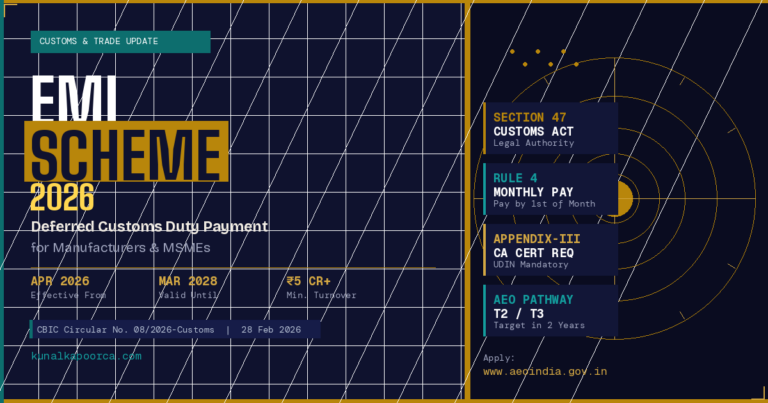

EMI Scheme 2026: Deferred Customs Duty for Manufacturers.

EMI Scheme 2026: Deferred Customs Duty for Manufacturers | Kunal…

-

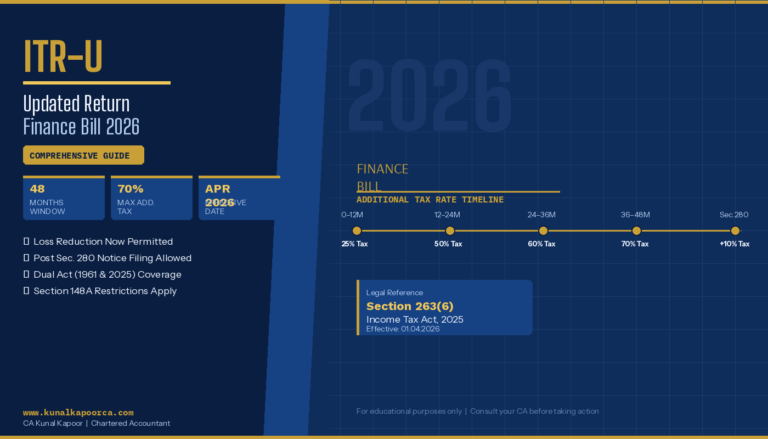

ITR-U (Updated Return) Under Finance Bill 2026:

Everything You Need to Know About the New Framework ⚡…

-

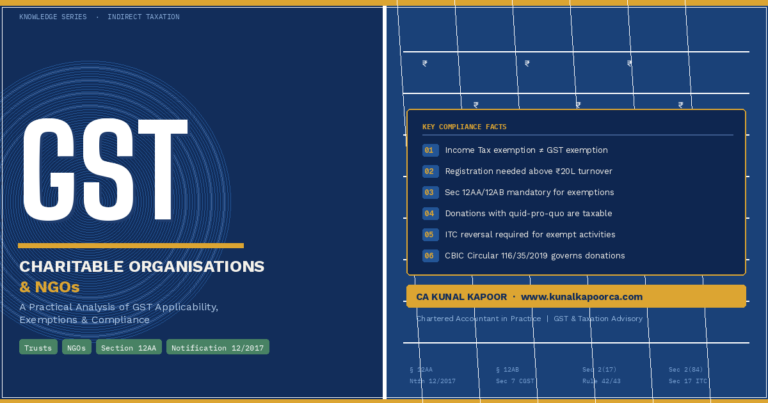

GST on Charitable Organisations: What Every Trust & NGO Must Know.

Charitable organisations — trusts, societies, and NGOs — occupy a…

-

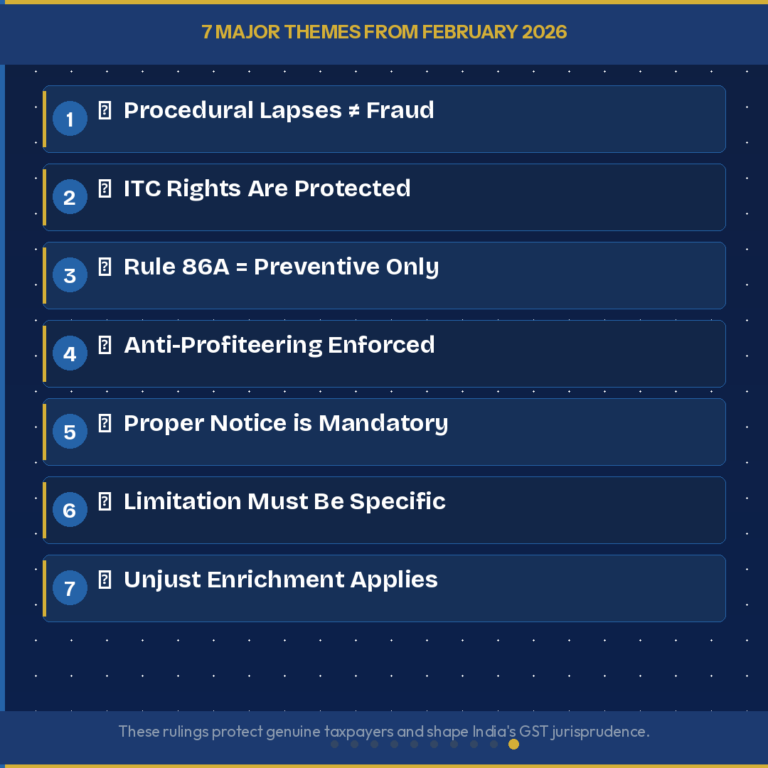

Top 8 GST Judgments February 2026 | ITC, Section 74, Rule 86A, Refund & Anti-Profiteering | Key Rulings for Taxpayers.

Introduction: Why February 2026 GST Rulings Matter February 2026 has…

-

Critical Tax & Regulatory Updates Every Indian Business Must Know – Week Ending 1st March 2026

The regulatory machine never stops. This week — ending 1st…

-

DGGI Investigations & GST Personal Liability for Directors.

The landscape of indirect taxation in India is shifting from…