Missed the December 15 Advance Tax Deadline? Here is Your Damage Control Plan

The December 15, 2025 deadline for paying 75% of your Advance Tax liability has passed. For many business owners and professionals in the hustle of the year-end, this date often slips through the cracks.

If you haven’t paid—or if you paid less than required due to underestimating your Q3 profits—the Income Tax Department’s meter for interest is now running.

Here is an expert breakdown of what happens next and how you can stop the bleeding.

1. The Penalty: Understanding Section 234C

If you failed to deposit 75% of your total tax liability by Dec 15, you are liable for interest under Section 234C.

- Interest Rate: 1% per month.

- Duration: It is charged for a period of 3 months on the shortfall amount.

- Deferment Condition: Interest is not applicable if the shortfall is due to an unexpected Capital Gain or Dividend income, provided you pay the tax on such income in the next installment (March 15).

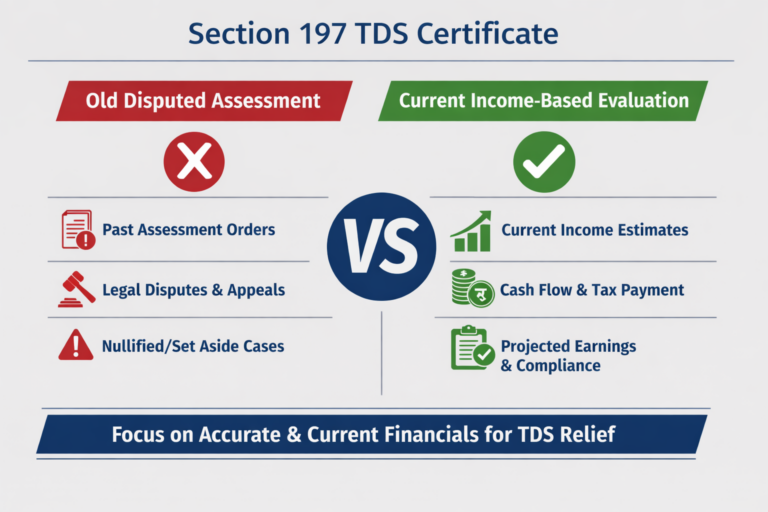

2. Why You Must Pay Before March 31st (Section 234B)

Many taxpayers think, “I’ll just pay it all when I file my return in July.” This is a costly mistake.

If you don’t pay at least 90% of your total tax by March 31, 2026, a new penalty kicks in under Section 234B. Unlike 234C (which is fixed), Section 234B interest continues to accumulate every single month until you finally pay the tax.

3. Immediate Steps for Noida & Delhi NCR Businesses

- Recalculate Now: If you are a startup or freelancer in Noida seeing a revenue spike in December, your estimated tax liability has likely increased.

- Use Challan ITNS 280: Deposit the shortfall immediately. Select “Advance Tax (100)” as the type of payment.

- Check Form 26AS: Ensure your TDS credits are updated. Sometimes, high TDS deductions can offset your advance tax liability, saving you from interest.

Expert Note: “Paying the tax now won’t remove the 234C interest for the Dec quarter, but it will protect you from the cascading effect of Section 234B interest come April.”

Need a quick computation? Don’t rely on rough estimates. Let Kunal Kapoor & Associates calculate your exact liability to ensure you don’t overpay or underpay.