Section 43B(h) & New MSME Limits 2025: A Guide for Startups

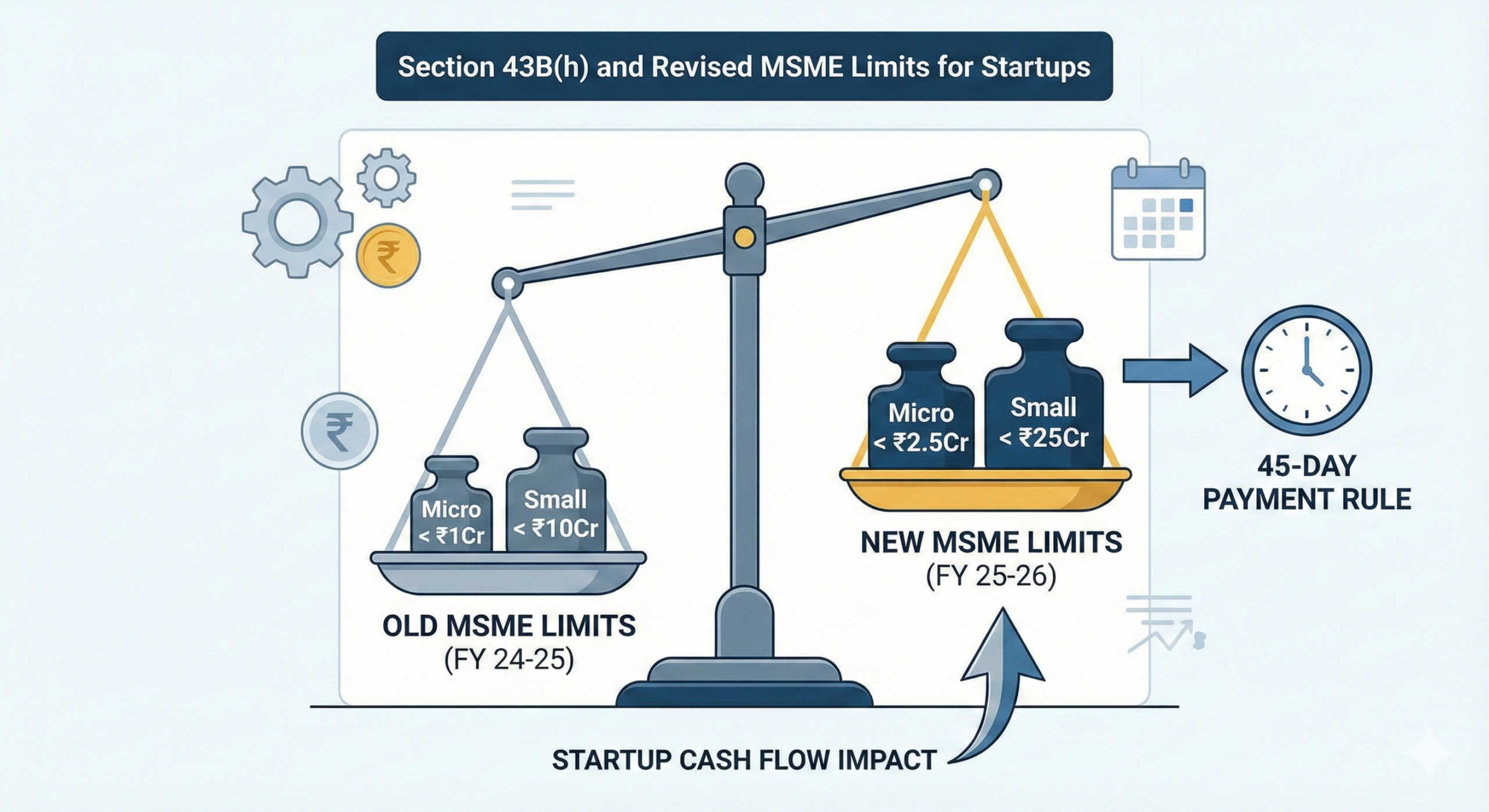

Budget 2025 revised MSME investment limits to ₹2.5 Cr (Micro) and ₹25 Cr (Small). Learn how this impacts your Section 43B(h) payment compliance for FY 2025-26

The “45-day payment rule” under Section 43B(h) of the Income Tax Act caused significant disruption when first introduced. Recognizing the challenges, the government adjusted the MSME classification thresholds in the 2025 Budget. As we approach the end of 2025, Startups must understand how these new definitions apply to their vendor payments to ensure tax deductions are not disallowed in the upcoming assessment.

1. The Revised MSME Definitions (Effective from April 1, 2025)

To prevent “de-registration” and encourage growth, the investment/turnover limits were hiked:

| Category | Old Limit (Investment) | New Limit (Investment) – 2025 |

| Micro | < ₹1 Crore | < ₹2.5 Crore |

| Small | < ₹10 Crore | < ₹25 Crore |

(c) Applicable for FY 2025-26 (Assessment Year 2026-27).

2. Why This Matters for Section 43B(h)

Section 43B(h) disallows tax deductions for payments made to Micro and Small enterprises beyond 45 days (or 15 days without agreement).

- The Shift: With the higher thresholds, more of your vendors now fall under the “Small” category.

- The Risk: Vendors who were previously “Medium” (and exempt from 43B(h)) might now be “Small” due to the limit hike, bringing them under the 45-day payment discipline.

3. Action Plan for Startups (December 2025)

You are currently in Q3 of FY 2025-26.

- Re-verify Udyam Certificates: Ask all vendors for their latest Udyam Registration Certificate. The status might have changed post-April 2025.

- Check the “Type”: If a vendor is “Medium” or a “Trader”, Section 43B(h) does NOT apply.

- Year-End Cash Flow Planning: Ensure all invoices dated before Feb 15, 2026 are paid by March 31, 2026, to guarantee deduction in this financial year.

4. Case Law Update: Safari Retreats Principle

While Safari Retreats (Odisha HC) dealt with GST/Construction, recent tribunal views in 2025 have reinforced that Section 43B(h) is a non-negotiable compliance, irrespective of the “hardship” to the payer. Courts are prioritizing the MSME Act’s intent over the payer’s liquidity issues.

FAQs

Q: My vendor is a trader. Do I need to pay them in 45 days for tax deduction?

A: No. Traders are registered on Udyam only for Priority Sector Lending, not for the benefits of delayed payment protection under the MSME Act (and consequently Section 43B(h)).

Q: If I miss the payment, is the expense lost forever?

A: No. It is disallowed in the current year but allowed in the year you actually pay. However, for a Startup seeking Section 80-IAC profit-linked deductions, inflating taxable income now (due to disallowance) is cash-inefficient.

Legal Disclaimer: The MSME status of vendors is dynamic. Always verify the Udyam number on the official portal.