Beyond Charity: A CFO’s Strategic Guide to CSR Compliance (Section 135) in FY 2025-26

Corporate Social Responsibility (CSR) in India has evolved from a voluntary “good to do” activity into a rigorous statutory obligation. For Indian corporates, Section 135 of the Companies Act, 2013 is no longer just about writing a cheque to a charitable trust; it is about project management, strict utilization trails, and penal consequences for non-compliance. In FY 2025-26, the focus of the Ministry of Corporate Affairs (MCA) has shifted heavily towards the treatment of Unspent CSR and Impact Assessment.

1. The Applicability Threshold: Are You Covered?

Your company must comply with CSR provisions if it meets any one of the following criteria during the immediately preceding financial year:

- Net Worth: ₹500 Crore or more; OR

- Turnover: ₹1,000 Crore or more; OR

- Net Profit: ₹5 Crore or more.

CA Note: The term “Net Profit” here is calculated specifically as per Section 198 of the Companies Act. This is often different from the profit shown in your P&L statement. Adjustments for capital profits/losses and income tax must be made.

2. The 2% Spend & The Role of the Committee

Once triggered, the company must spend at least 2% of the Average Net Profits of the three immediately preceding financial years.

- CSR Committee: Mandatory if the CSR obligation exceeds ₹50 Lakhs. It must comprise at least 3 directors (with one Independent Director, if applicable).

- Exemption: If the obligation is below ₹50 Lakhs, the Board itself can discharge the duties of the Committee.

3. Implementation Modes: How to Spend?

You cannot simply “donate” the money. The law (Rule 4) allows execution through:

- Direct Implementation: The company undertakes projects itself.

- Section 8 Company/Trust/Society: Established by the company or the government.

- Independent Implementing Agencies: Entities with a valid CSR-1 Registration Number and a track record of 3 years.

Critical Compliance: Ensure your vendor/NGO has filed Form CSR-1 with the MCA. Without a valid CSR-1 number, the expenditure may be disallowed during statutory audit.

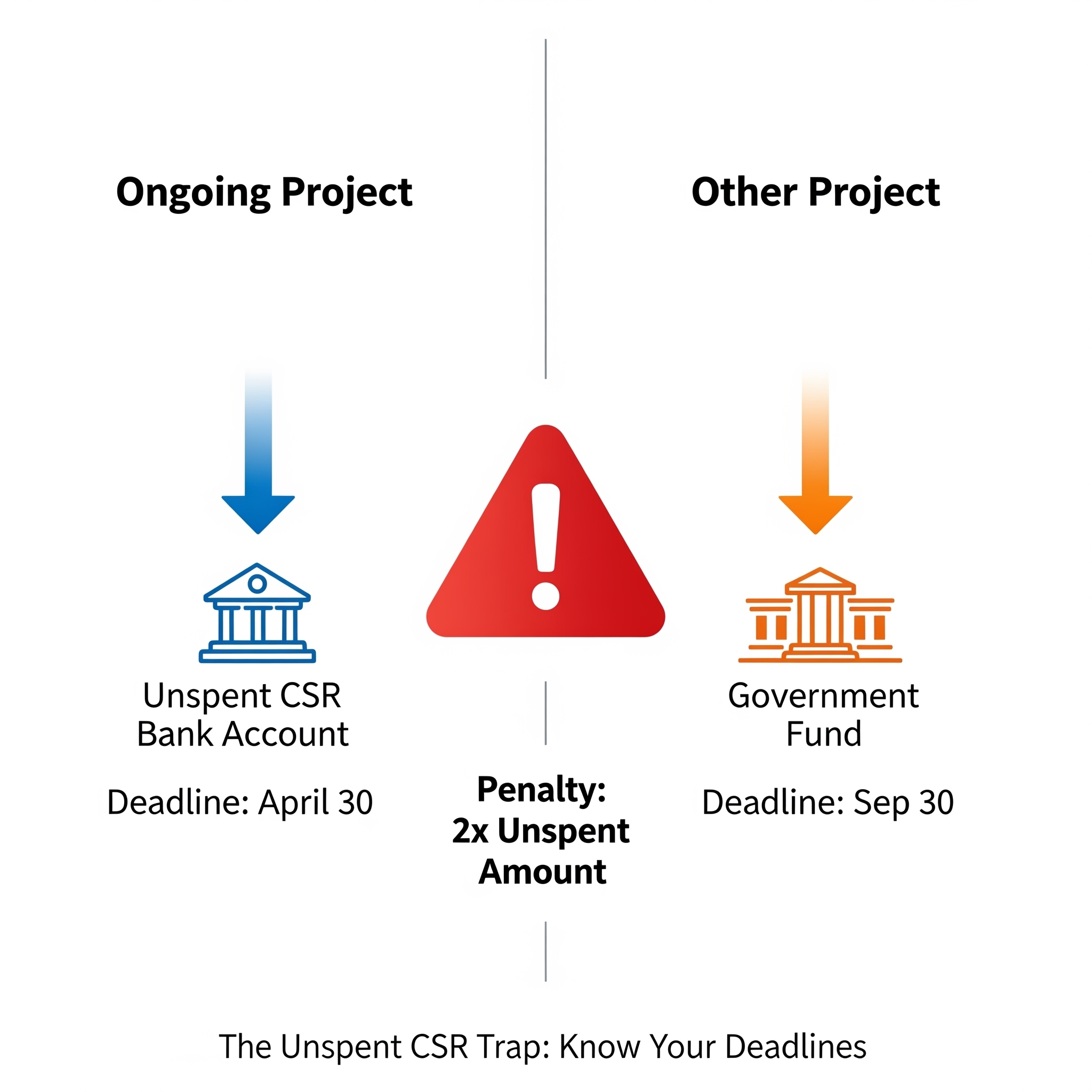

4. The “Unspent CSR” Trap: Ongoing vs. Other Projects

This is where most corporates face scrutiny. If you fail to spend the full 2% by March 31st, the treatment depends entirely on the nature of the project. This flowchart explains the critical decision-making process:

A. For “Ongoing Projects” (Multi-year projects max 3+1 years)

- Action: You must transfer the unspent amount to a special bank account called the “Unspent CSR Account” within 30 days of the end of the FY (i.e., by April 30).

- Utilization: This money must be spent within the next 3 financial years.

- Failure: If still unspent after 3 years, it must be transferred to a Schedule VII fund (like PM CARES, Clean Ganga Fund) within 30 days.

B. For “Other than Ongoing Projects” (One-time/Annual)

- Action: No special bank account is needed.

- Deadline: You must transfer the unspent amount directly to a Schedule VII fund within 6 months of the end of the FY (i.e., by September 30th).

5. Impact Assessment: The New Audit Frontier

For large CSR spenders, self-declaration is no longer enough.

- Who needs it? Companies with an average CSR obligation of ₹10 Crore or more in the 3 preceding years.

- Which projects? Projects with an outlay of ₹1 Crore or more completed at least 1 year ago.

- The Cost: You can claim expenditure on Impact Assessment up to 2% of total CSR obligation or ₹50 Lakh, whichever is higher.

Action Points for CFOs

- Calculate Section 198 Profit: Do not rely on P&L profit. Re-calculate strictly as per the Act.

- Verify CSR-1: Collect CSR-1 registration proofs from all NGO partners before releasing payments.

- Board Resolution: Clearly classify projects as “Ongoing” or “One-time” in the Board Minutes before the year ends to avail the “Unspent Account” facility.

FAQs

Q: Can we claim excess CSR spend as a set-off next year? A: Yes. Excess CSR spent can be set off against the obligation for the next 3 succeeding financial years, provided the Board passes a resolution to that effect.

Q: Is penalty applicable for non-compliance? A: Yes. It is no longer a criminal offence, but a civil wrong with heavy penalties. The company is liable for a penalty of twice the unspent amount (capped at ₹1 Crore), and every officer in default is liable for 1/10th of the unspent amount (capped at ₹2 Lakhs).

Legal Disclaimer: This article is for general information and does not constitute legal advice. CSR rules are subject to frequent amendments. Consult a Chartered Accountant for specific applicability.