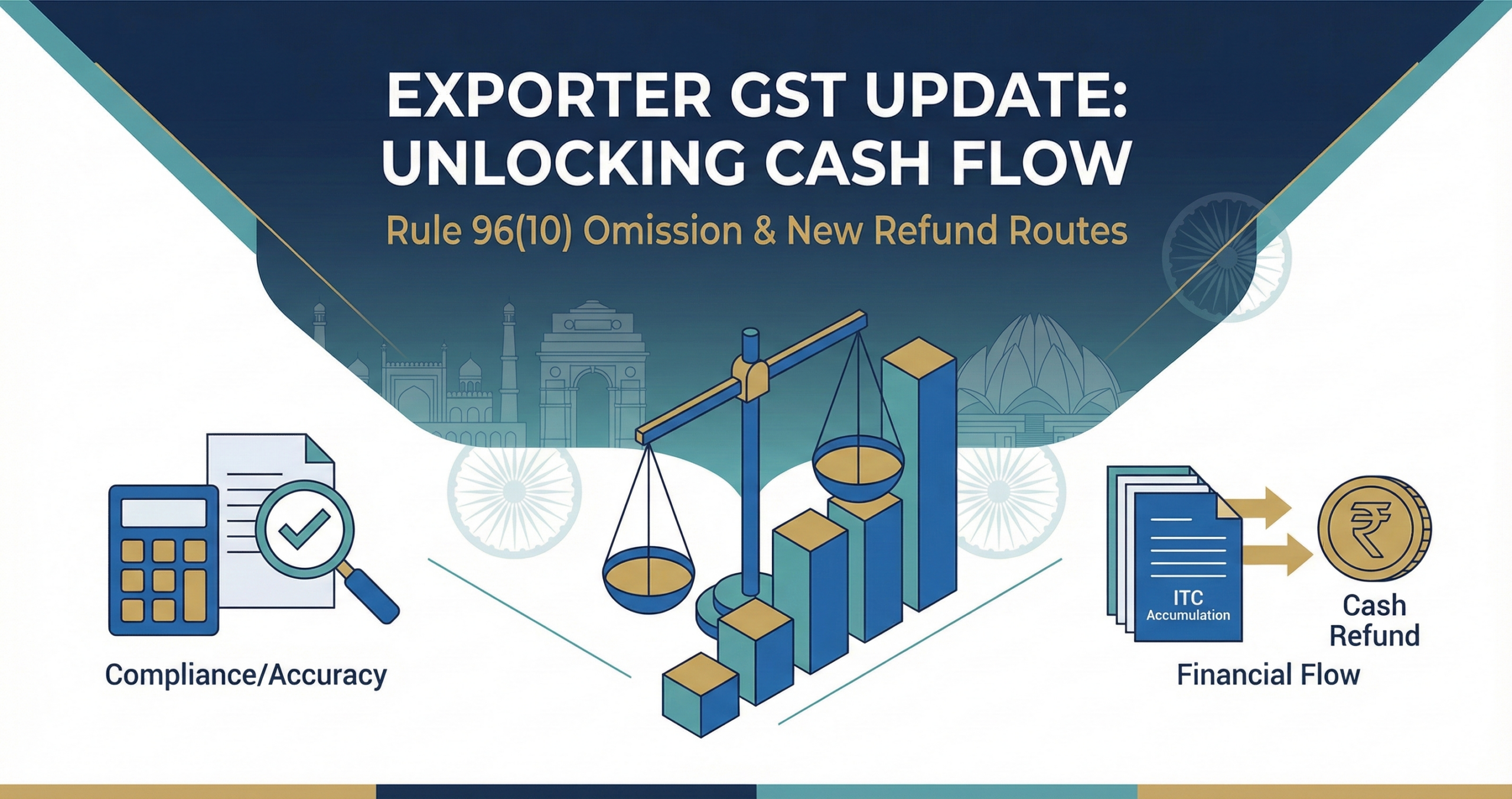

Game Changer for Exporters: Unlocking Cash Flow After the Omission of GST Rule 96(10)

GST Rule 96(10) Omission Explained

For years, exporters across Delhi, Gurgaon, and Noida operating under duty exemption schemes like Advance Authorization (AA), Export Promotion Capital Goods (EPCG), or functioning as Export Oriented Units (EOUs) faced a significant restriction under the GST regime. This restriction, known as Rule 96(10) of the CGST Rules, often led to accumulated Input Tax Credit (ITC) and cash flow bottlenecks.

The government has recently provided major relief by retroactively omitting Rule 96(10) through Notification No. 20/2024–Central Tax. This change, effective retrospectively from July 1, 2017, fundamentally alters how exporters using these schemes can claim refunds.

As a Chartered Accountant firm serving the dynamic export hubs of Delhi NCR, we analyze what this crucial amendment means for your business finances and compliance strategy.

Understanding the Old Restriction: What Was Rule 96(10)?

Under GST, exporters have two primary options for zero-rated supplies:

- Export under Bond/LUT: Export without paying IGST and claim a refund of accumulated unutilized ITC.

- Export on Payment of IGST (Rebate Mechanism): Pay IGST on exports (using ITC or cash) and claim a refund of the IGST so paid.

Before its omission, Rule 96(10) barred exporters from using the second option (the Rebate mechanism) if they had imported inputs or capital goods without payment of IGST under schemes like AA, EPCG, or as an EOU. These exporters were forced to use the LUT route.

While the LUT route works, it often results in the accumulation of ITC—especially capital goods ITC, which is generally not refundable under the LUT mechanism. This tied up valuable working capital for many manufacturing exporters in industrial zones like Noida and Manesar.

The New Opportunity: Flexibility for AA and EPCG Holders

With the retrospective omission of Rule 96(10), the restriction is gone.

Exporters who import goods duty-free under exemption schemes can now choose to export on payment of IGST and claim a refund of the IGST paid.

This is a significant strategic advantage. Shifting to the rebate mechanism allows exporters to utilize their accumulated ITC balances (including capital goods ITC and overhead ITC) to pay the output IGST liability on exports, and then receive that amount back as a cash refund from customs. This can drastically improve cash flow rotation.

The Crucial Catch: Section 16(4) of the IGST Act

While the door to the rebate mechanism is now open, it is not a free-for-all. The government simultaneously amended Section 16(4) of the IGST Act to introduce a necessary safeguard.

Here is the critical compliance point: If you avail of duty exemption schemes (like AA/EPCG) for importing inputs/input services, you are restricted from utilizing the ITC availed on those specific exempted inputs to pay output IGST on exports.

In simple terms: You cannot use the benefit twice. You cannot import duty-free AND use ITC related to those imports to pay output tax for a rebate.

How do you pay the IGST then? To utilize the rebate route, you must discharge the output IGST liability using:

- ITC availed on other domestic procurements (overheads, raw materials not under AA).

- ITC availed on capital goods (even if procured under EPCG, as the restriction primarily targets inputs).

- Cash payments via the electronic cash ledger.

Scenario Analysis: How It Works in Practice

Let’s assume a garment exporter in Gurgaon, M/S NCR Tex:

- Imports fabric duty-free under Advance Authorization (AA).

- Buys buttons and thread domestically (paying GST).

- Has accumulated ITC from capital machinery purchased last year.

Pre-Amendment (Old Rule): M/S NCR Tex had to export under LUT. They got a refund of the ITC on buttons/thread, but the ITC on capital machinery remained stuck in their credit ledger.

Post-Amendment (New Rule): M/S NCR Tex can now opt to export on payment of IGST.

- They calculate output IGST of ₹5 Lakhs on a shipment.

- They cannot use any theoretical ITC related to the duty-free fabric import.

- However, they utilize ₹5 Lakhs of their accumulated capital goods ITC to pay this output liability.

- Once the export is complete, customs automatically refunds the ₹5 Lakhs to their bank account.

Result: Frozen capital goods ITC is converted into cash.

Key Actionable Insights for Delhi NCR Businesses

For CFOs and business owners in the region, this amendment requires immediate strategic review:

- Cost-Benefit Analysis: Evaluate if switching from the LUT route to the Rebate route is beneficial. If you have significant accumulated ITC (especially on capital goods or overheads), the switch is likely advantageous for cash flow.

- Segregation of ITC Accounts: Your accounting systems must be robust enough to distinguish between ITC availed on inputs imported under exemption schemes versus other ITC. You need accurate data to ensure you don’t violate Section 16(4) of the IGST Act.

- Retrospective Impact: Since the omission is retrospective from 2017, assess if past transactions need re-evaluation, though practical implementation for closed years may be complex due to time-barring periods for refunds. Focus primarily on current and future strategy.

FAQs on Rule 96(10) Omission

Q: I am an EPCG license holder in Noida. Can I now export on payment of IGST? A: Yes, the omission of Rule 96(10) allows you to use the rebate option.

Q: Can I use the ITC related to my Advance Authorization imports to pay the output IGST? A: No. Section 16(4) of the IGST Act prohibits utilizing ITC on inputs/input services exempted on import for paying output tax on exports. You must use other accumulated ITC or cash.

Q: Will this help liquidate my accumulated capital goods ITC? A: Yes, this is one of the biggest benefits. You can utilize capital goods ITC to pay the output IGST on exports and claim it back as a refund.

Conclusion

The omission of Rule 96(10) is a welcome move that simplifies the GST refund landscape for exporters using duty exemption schemes. It offers a vital pathway to unlock trapped working capital in a competitive market like Delhi NCR. However, navigating the interaction between the rule omission and the restrictions of Section 16(4) of the IGST Act requires careful compliance.

Don’t leave cash on the table or risk non-compliance.

Contact us today to conduct a thorough analysis of your export mechanism and ensure you are maximizing your refunds efficiently and legally.