The DPDP Act 2023 is Here: A Compliance Wake-Up Call for Delhi NCR Businesses

An in-depth analysis of India’s new data privacy law and actionable steps for CFOs and business owners to ensure compliance and avoid heavy penalties.

In the rapidly digitizing landscape of the Delhi NCR business hub—spanning the corporate towers of Gurgaon to the industrial sectors of Noida—data has become the new currency. Every transaction, employee onboarding, and customer interaction generates digital footprints. Until recently, the regulations governing this data were fragmented.

The enactment of the Digital Personal Data Protection Act, 2023 (DPDP Act) marks a seismic shift in India’s legal framework. It transforms how businesses must handle personal information, moving from a relatively laissez-faire approach to a stringent, accountability-based regime.

For CFOs, business owners, and finance professionals in the National Capital Region, understanding this Act is no longer optional—it is a critical compliance requirement. The Act introduces significant obligations for businesses and imposes severe financial penalties for non-compliance. This blog provides a professional overview of the DPDP Act and outlines the necessary steps to fortify your business against regulatory risks.

Decoding the Framework: Key Definitions and Scope

The new framework simplifies data privacy into a relationship between two primary entities. It is crucial to understand where your business stands.

- Data Principal: The individual to whom the personal data relates (e.g., your customers, employees, or vendors).

- Data Fiduciary: The entity that determines the “purpose and means” of processing the personal data. Most businesses collecting data will fall under this category.

Scope of the Act: The Act applies to the processing of digital personal data within India. This includes data collected online, or data collected offline and subsequently digitized. Critically for multinational companies operating out of Delhi NCR, the Act also applies to processing data outside India if it relates to offering goods or services to Data Principals within India.

The Core Pillars of the DPDP Act 2023

The legislation is built on several fundamental principles designed to empower individuals and hold businesses accountable.

1. The New Consent Architecture

The days of pre-ticked boxes and buried privacy clauses are over. The Act mandates that consent must be free, specific, informed, unconditional, and unambiguous.

- Notice Requirement: Before asking for consent, Data Fiduciaries must provide a clear notice explaining what personal data is being collected and the purpose of processing it.

- Withdrawal of Consent: Data Principals have the right to withdraw consent as easily as it was given.

2. Legitimate Uses: When Consent Isn’t Needed

The Act recognizes that obtaining consent isn’t always practical. It defines “Legitimate Uses” where data can be processed without explicit consent. This includes:

- Adhering to any judgment or order issued under any law.

- Responding to a medical emergency.

- Employment purposes (e.g., processing payroll or safeguarding the employer from corporate espionage).

3. Rights of the Data Principal

The Act empowers individuals with significant rights, including:

- Right to Access: Knowing what data is being processed and the identities of all Data Fiduciaries with whom the personal data has been shared.

- Right to Correction and Erasure: Demanding the correction of inaccurate data or the deletion of data that is no longer necessary for the specified purpose.

- Right to Grievance Redressal: Businesses must have a clear mechanism to address complaints.

Implications for Businesses in Delhi NCR

The compliance burden for businesses in regions like Delhi, Gurgaon, and Noida has increased substantially.

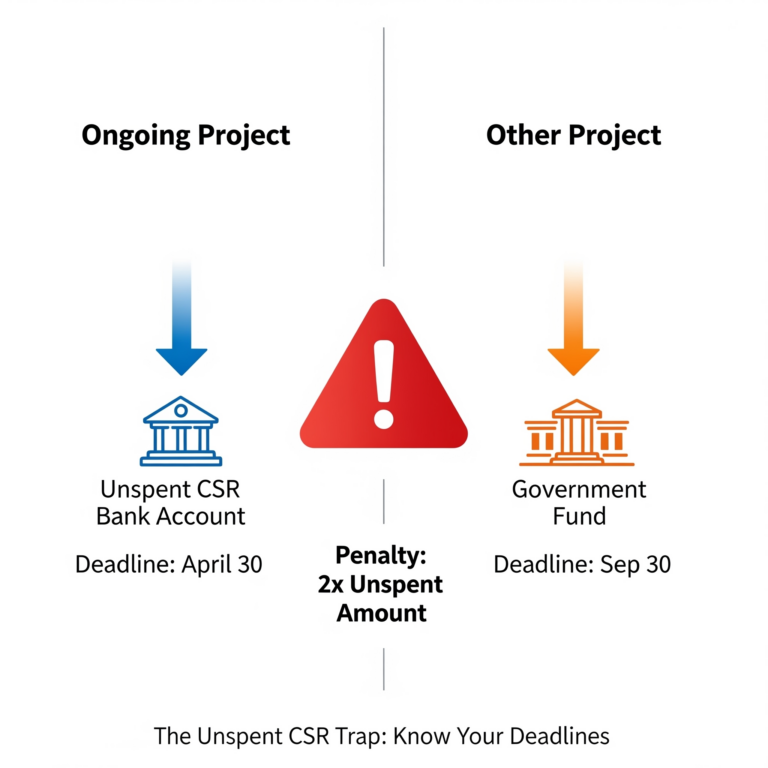

The Cost of Non-Compliance: Unlike previous drafts, the final Act does not include criminal liability (imprisonment). However, the financial penalties are severe designed to cripple non-compliant entities. Penalties range up to ₹250 crore for failing to take reasonable security safeguards to prevent a personal data breach.

Significant Data Fiduciaries (SDF): The Central Government will notify certain entities as SDFs based on the volume and sensitivity of data they handle. Many large tech firms, e-commerce platforms, and financial institutions centered in NCR may fall into this category. SDFs face higher compliance obligations, including appointing a Data Protection Officer (DPO) based in India, conducting periodic data protection impact assessments, and undergoing independent audits.

Actionable Compliance Insights: A CA’s Perspective

As financial and compliance advisors, we recommend immediate steps to align with the new regime. Data privacy is now a boardroom issue, not just an IT concern.

- Conduct a Comprehensive Data Mapping Exercise: You cannot protect what you don’t know you have. Audit your systems to understand what personal data you collect, where it is stored, who has access to it, and why you need it.

- Revise Privacy Notices and Consent Forms: Review current customer and employee onboarding documents. Ensure your privacy notices are available in English and relevant regional languages, clearly stating the purpose of data collection.

- Implement Robust Security Safeguards: The Act mandates “reasonable security safeguards.” Invest in cybersecurity infrastructure to prevent breaches. A breach now carries massive financial risk.

- Establish a Grievance Redressal Mechanism: Set up a clear, accessible channel for individuals to exercise their rights (access, correction, erasure) and file complaints.

- Review Third-Party Contracts: If you use Data Processors (like third-party payroll vendors or cloud storage providers), review contracts to ensure they also comply with security standards. As the Data Fiduciary, the ultimate liability rests with you.

Frequently Asked Questions (FAQs)

Q: Does this Act apply to B2B data? The Act applies to “personal data,” which means data about an individual. Purely B2B data related to a company entity might not be covered, but data regarding contact persons within that company (names, personal emails) likely will be.

Q: We are a small startup in Noida. Are we exempt? The Act currently does not provide blanket exemptions for MSMEs based on size, though the government may notify certain exemptions later. If you handle digital personal data, you must comply with the core principles.

Q: What happens if a data breach occurs? You have a dual reporting obligation. You must inform the newly established Data Protection Board of India and every affected Data Principal about the breach.

Conclusion

The DPDP Act 2023 is a transformative piece of legislation that demands a cultural shift in how Indian businesses handle data. For the thriving business ecosystem of Delhi NCR, this is the moment to transition from reactive data practices to proactive data governance.

Compliance is not merely about avoiding penalties; it is about building trust with your customers and employees in the digital age.

Is your business ready for the DPDP Act regime? Don’t wait for a penalty notice to evaluate your data practices. Contact Kunal Kapoor & Associates today for a comprehensive data compliance assessment and ensure your business is future-proofed against regulatory risks.