Capital Gains Tax on ETFs vs. Equity Mutual Funds: A 2026 Guide for Delhi NCR Investors.

Introduction

As financial markets evolve, investors in Delhi NCR are looking beyond traditional fixed deposits and gold. From tech-savvy professionals in Gurgaon to business owners in Noida, portfolios now frequently include Exchange Traded Funds (ETFs), international equities, and specialized mutual funds.

However, with the introduction of Section 50AA and amendments in the Finance Act (No. 2) 2024, the taxation landscape has shifted significantly. A common misconception we see at Kunal Kapoor & Associates is that all “market-linked” products are taxed the same. They are not. Understanding the nuance between a standard Equity Mutual Fund and a Gold ETF or an International ETF is critical to preventing a surprise tax liability at the end of the financial year.

The Core Definitions: Short-Term vs. Long-Term (Section 2(42A))

Before diving into rates, we must understand the “holding period”—the duration you hold an asset before selling. This period determines whether your gain is Short-Term (STCG) or Long-Term (LTCG).

- Listed Equity & Equity Mutual Funds: The threshold is 12 months.

- Immovable Property: The threshold is 24 months.

- Other Assets (Unlisted shares, Foreign assets): Typically 24 months.

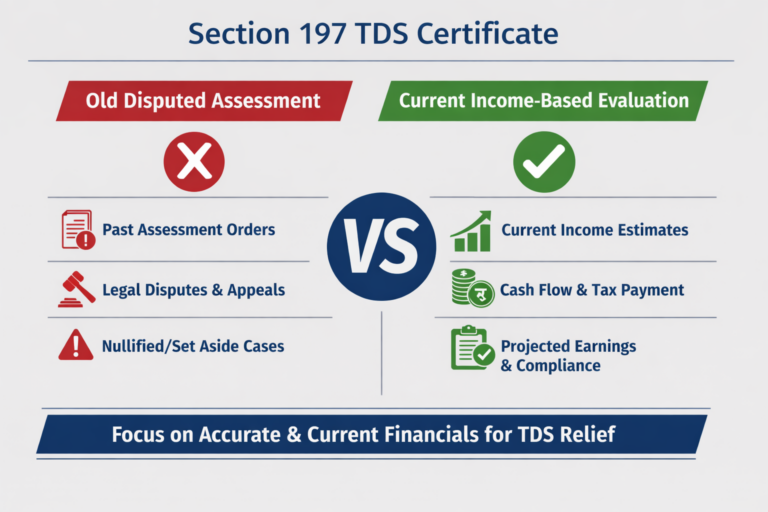

The “Specified Mutual Fund” Trap (Section 50AA)

The most significant change for conservative investors relates to Section 50AA.

Previously, debt mutual funds enjoyed indexation benefits if held for over three years. That is no longer the case. Under Section 50AA, any fund where not more than 35% of the proceeds are invested in domestic equity shares is classified as a “Specified Mutual Fund.”

What does this mean for you?

Whether you hold these funds for 1 month or 10 years, the gains are deemed Short-Term Capital Gains. They will be added to your total income and taxed at your applicable slab rate.

This rule applies to:

- Debt Mutual Funds

- Gold and Silver ETFs

- International ETFs listed in India (e.g., Hang Seng or Nasdaq ETFs listed on NSE/BSE)

Comparative Analysis: Tax Rates after July 23, 2024 For investors in Delhi and Noida, where high-net-worth portfolios often mix asset classes, here is the definitive breakdown of how your gains will be taxed.

1. Domestic Equity Shares & Equity Mutual Funds

- Condition: Securities Transaction Tax (STT) must be paid.

- Short-Term (< 12 Months): Taxed at 20% (u/s 111A).

- Long-Term (> 12 Months): Taxed at 12.5% (u/s 112A).

- Note: You still enjoy the ₹1.25 Lakh exemption on LTCG per financial year.

2. Non-Equity Funds (Debt, Gold, Silver, Liquid Funds)

- Holding Period: Irrelevant.

- Tax Rate: Slab Rate (u/s 50AA).

- Impact: If you fall in the 30% tax bracket, your returns on Gold ETFs are effectively taxed at 30% plus cess, reducing the post-tax yield significantly compared to physical gold held long-term.

3. International Equities (The Complexity)

This is where many errors occur. Taxation depends on where the asset is listed.

- International ETFs Listed in India: Treated as Debt/Specified Funds. Always Short-Term (Slab Rate).

- Direct Foreign Stocks (e.g., Buying US Tech Stocks directly):

- These are treated as unlisted securities in India.

- Holding Period: > 24 Months is Long-Term.

- Tax Rate:

- < 24 Months: Slab Rate.

- > 24 Months: 12.5% (u/s 112). Note: Section 112A (10% or exemption) does not apply here because STT is not paid in India.

Summary Table: Capital Gains Tax Matrix

| Asset Class | Holding Period | Tax Rate (Post-July 2024) | Applicable Section |

| Domestic Equity Shares / Equity MFs | ≤ 12 Months | 20% | 111A |

| Domestic Equity Shares / Equity MFs | > 12 Months | 12.5% | 112A |

| Gold/Silver/Debt ETFs & Funds | Any Period | Slab Rate | 50AA |

| International ETFs (Listed in India) | Any Period | Slab Rate | 50AA |

| Foreign Stocks (Listed Abroad) | ≤ 24 Months | Slab Rate | Ordinary Income |

| Foreign Stocks (Listed Abroad) | > 24 Months | 12.5% | 112 |

Key Implications for Delhi NCR Businesses

1. Corporate Treasury Management

Many Noida-based SMEs park surplus cash in liquid funds or debt ETFs. With Section 50AA, the tax arbitrage is gone. These gains are now taxed as normal business income. It may be time to re-evaluate your treasury strategy.

2. Portfolio Rebalancing

If you are holding International ETFs listed on Indian exchanges thinking they will qualify for LTCG, review your portfolio. The tax drag (Slab Rate vs. 12.5%) can erode years of compounding.

Frequently Asked Questions (FAQs)

Q: Does the ₹1.25 Lakh exemption apply to my Gold ETF gains?

A: No. The ₹1.25 Lakh exemption under Section 112A applies only to long-term equity assets. Gold ETFs are taxed at your slab rate starting from Rupee 1.

Q: I bought a US Tech ETF on the NSE. Is it long-term after 12 months?

A: No. Since it invests less than 35% in domestic equity, it falls under Section 50AA. It is always short-term, taxed at your slab rate.

Conclusion

Tax efficiency is just as important as investment returns. With the removal of indexation benefits and the introduction of Section 50AA, the “set it and forget it” approach to taxation no longer works.

As we approach the end of the financial year, ensure your capital gains statements are analyzed correctly to avoid penalties or excess tax payments.

Need a Portfolio Tax Health Check?

At Kunal Kapoor & Associates, we specialize in tax planning for investors and businesses in Noida and Delhi NCR. Contact us today to optimize your tax liability.