Section 197 Certificates Cannot Be Denied Based on Overturned Assessments: Delhi HC Clarifies

What if your cash flow is blocked today because of a tax demand that no longer legally exists? The Delhi High Court has now given a clear answer—and major relief—to taxpayers seeking Section 197 (Lower/Nil TDS) certificates.

Background: Why Section 197 Matters for Businesses

Section 197 of the Income-tax Act, 1961 allows eligible taxpayers to apply for a lower or nil TDS certificate where the standard TDS deduction is significantly higher than their actual tax liability.

For many businesses—especially startups, service providers, crypto traders, and fast-scaling companies—TDS can severely strain working capital.

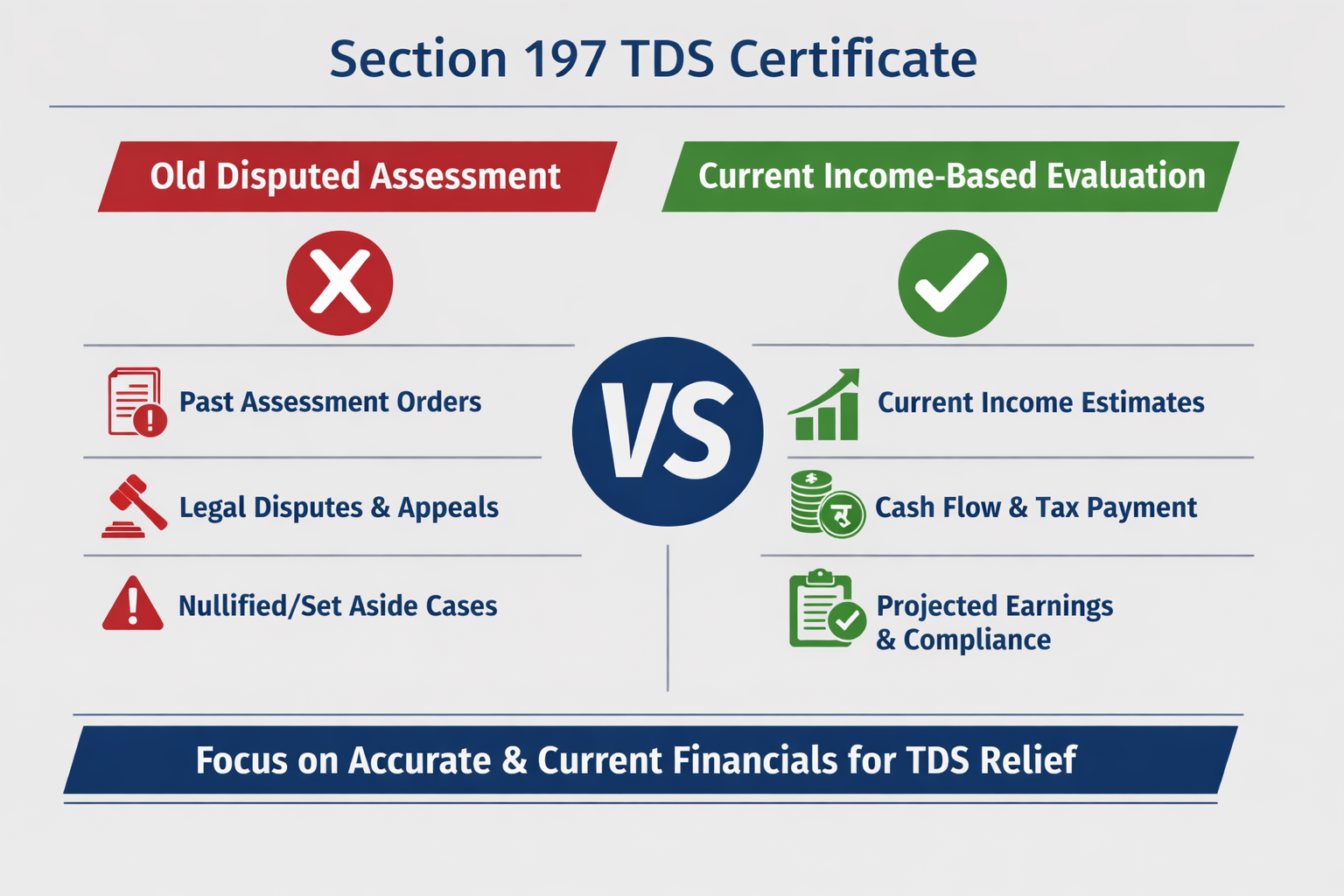

However, in practice, tax authorities often deny Section 197 certificates by relying on:

- Past high-pitched assessments

- Additions that are under appeal

- Orders already set aside or quashed by appellate authorities

This approach has now been firmly rejected by the Delhi High Court.

Key Ruling: What Did the Delhi High Court Say?

In a recent judgment, the Delhi High Court held that:

Section 197 certificates cannot be denied merely because earlier assessments were overturned, quashed, or set aside.

Core Principle Laid Down by the Court

The Assessing Officer must evaluate:

- Current year income estimates

- Actual tax liability

- Cash flow position

- Past compliance record

❌ Reliance on disputed or nullified past assessments is not legally sustainable.

This ruling reinforces that Section 197 is a forward-looking provision, not a punitive tool.

Why This Judgment Is a Big Deal

1. Restores the Purpose of Section 197

Section 197 exists to ensure that:

- TDS reflects real tax liability

- Businesses are not forced to overpay tax upfront

- Cash flow is not unnecessarily blocked

The judgment realigns administrative practice with legislative intent.

2. Protects Taxpayers from Arbitrary Denials

Many businesses faced rejection simply because:

- Past additions existed (even if deleted on appeal)

- Litigation history was used as a blanket excuse

The Court has made it clear: past disputes ≠ current liability.

3. Limits Arbitrary Discretion

Tax authorities must now rely on current financial data, not historical disputes.

Who Benefits from This Ruling?

This judgment is especially relevant for:

- Business Owners & CFOs managing cash flow

- Startup Founders with fluctuating profitability

- Crypto Traders & Web3 Businesses facing high TDS under Section 194S

- Consultants & Professionals operating on thin margins

- Exporters & Service Providers with refund-heavy profiles

Practical Compliance Guidance: Applying for Section 197 Post-Ruling

When filing or re-filing a Section 197 application, focus on present financial reality.

Documents to Strengthen Your Application

- Estimated income for the current FY

- Computation of expected tax liability

- Filed ITRs and compliance history

- Advance tax / self-assessment tax challans

- Cash flow statements

📌 Tip:

Clearly disclose if past assessments were set aside or deleted, and attach appellate orders.

Real-World Example

Scenario

A Noida-based IT services company faced:

- High additions in earlier assessments

- Those additions were later deleted by appellate authority

Despite this, the Section 197 certificate was rejected citing “past assessment history”.

Outcome After Delhi HC Ruling

Such rejection is now legally unsustainable, as:

- Past overturned assessments carry no evidentiary value

- Current income estimation is decisive

Key Takeaways for Taxpayers

- Section 197 is year-specific

- Overturned assessments cannot prejudice future relief

- Cash flow impact is a valid consideration

- Proper documentation significantly improves approval chances

- Wrongful rejections can be challenged via writ petition

Frequently Asked Questions (FAQ)

Q1. Can Section 197 certificate be denied due to past assessment disputes?

No. As per the Delhi High Court, Section 197 certificates cannot be denied solely on the basis of assessments that have been overturned or set aside.

Q2. What factors should be considered while issuing a Section 197 certificate?

The Assessing Officer must consider:

- Current income estimates

- Tax liability

- Cash flow position

- Compliance history

Q3. Does past litigation automatically disqualify a taxpayer from Section 197 relief?

No. Litigation history alone cannot be a ground for rejection if the assessment no longer survives legally.

Q4. Is this ruling applicable across India?

While issued by the Delhi High Court, it has strong persuasive value and can be relied upon nationwide.

Q5. Can a rejected Section 197 application be challenged?

Yes. Arbitrary rejection can be challenged before the High Court under writ jurisdiction.

Call to Action

If your Section 197 application was rejected due to past assessments, this ruling may change your position entirely.

👉 Need help applying or challenging rejection? Contact Kunal Kapoor & Associates.