Budget 2026 Analysis: Navigating New ITR and TDS Changes

ITR, TDS TCS CHANGES

From new ITR due dates to game-changing TDS and TCS shifts, stay ahead of India’s evolving financial landscape.

Why it Matters?

The annual Budget is a potent cocktail of anticipation and apprehension. Budget 2026, unveiled on a Sunday, focuses on deep structural changes in the Income Tax framework. Staying informed is no longer optional; it’s absolutely crucial for effective Tax Planning.

Historical Context

“Income Tax in India originated in 1860… a reimagining is finally here with the 2025 Act.”

A Journey Through Time

For decades, our system was primarily shaped by the Income Tax Act, 1961. But the upcoming Income Tax Act, 2025 is poised to be a significant new chapter. It’s not just a revision; it’s a reimagining of how we handle wealth and contribution.

The Deadlines Mosh Pit

Remember the standard dates? July, October, November. COVID-19 and technical glitches turned these into a series of frantic extensions (FY 2019-20 to 2024-25). Budget 2026 aims to fix this chaos.

Proposed ITR Due Dates

AY 2026-27 onwards. Rationalized for your convenience.

July 31: Salaried / ITR-1 & 2 : A comforting consistency remains for standard individual filers.

Aug 31: Non-Audit / ITR-3 & 4: Welcome extension for small businesses and trusts.

Oct 31

Audit Cases: Maintaining the familiar window for companies and audited entities.

Nov 30: Transfer Pricing

Steady deadline for complex international transactions.

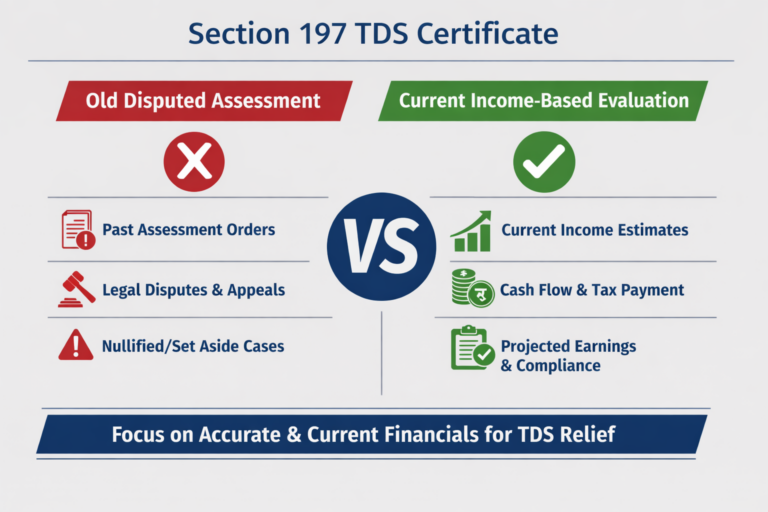

Major Shifts in TDS & TCS

These aren’t just mere tweaks; they significantly alter the financial landscape for individuals and businesses.

Reduced TCS Rates

Overseas education/medical and tour packages reduced to a flat 2%.

Simplified Compliance

Controversial higher TDS for non-filers (Sec 206AB) omitted from April 2025.

New Thresholds

LRS threshold increased to ₹10 Lakh. Loan-funded education exempt from TCS.

Extended Safety Net

Revised Returns: Correction window extended to March 31st of AY.

Belated Returns : File until December 31st.

Updated Returns: A generous 48-month window for legacy corrections.

The AI-Powered Tax Era

India is aggressively integrating Artificial Intelligence (AI) and Machine Learning into its tax system. Project Insight 2.0 and the National Tax Analytics Platform will provide a 360-degree view of taxpayers.

October 2026 : Launch of AI-driven public tax assessments and Faceless Assessments.

GST 2.0 : Automated data capture (OCR) and one-click filing systems.

Your Smart Action Plan

Prepare for FY 2025-26 and beyond

1Review & Adapt ITR Strategy

2Verify New TDS/TCS Thresholds

3Digitize Financial Records

Ready to navigate the future?

Connect with us today for tailored Tax Planning solutions that ensure your financial peace of mind!