Corporate Tax Strategy Post‑Budget 2026 – MAT Overhaul and New Buy‑Back Tax Rules

Budget 2026 significantly reshapes the corporate tax landscape by restructuring Minimum Alternate Tax (MAT) and overhauling the taxation of share buy‑backs. For corporates and late‑stage startups in Delhi NCR, these changes demand a fresh look at MAT planning and capital distribution strategies.

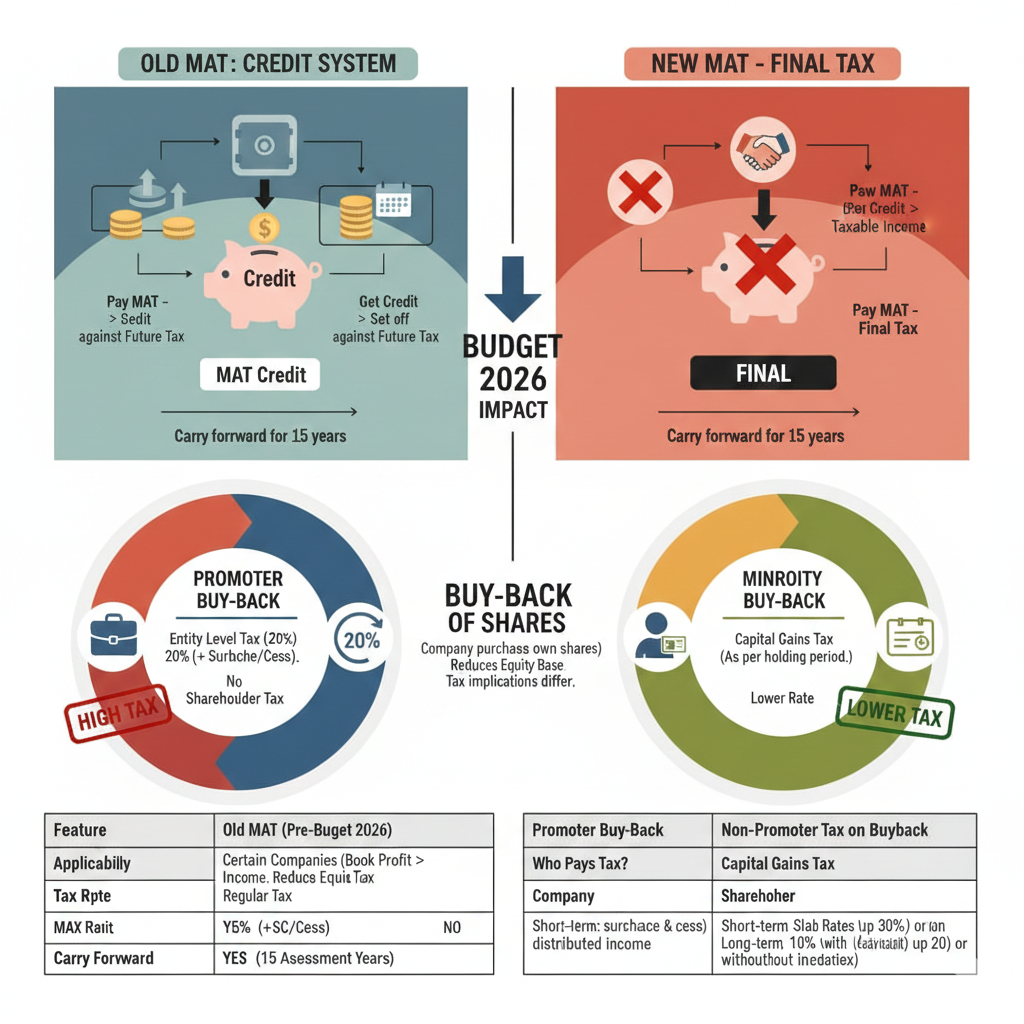

MAT – From Credit System to Final Tax

Existing Framework

Under existing provisions:

- Companies pay MAT on “book profits” at 15% if tax under normal provisions is lower.

- Excess MAT over normal tax can be carried forward as MAT credit for up to 15 years and set off in subsequent years when normal tax exceeds MAT.

- This framework was primarily aligned to the old regime.

Budget 2026 – Key Amendments

The Finance Bill 2026 proposes a shift with clear intent to phase out long‑term MAT credit dependence.

- MAT as Final Tax under Old Regime

- MAT paid under the old tax regime will be treated as final tax.

- No fresh MAT credit will accrue for MAT paid under the old regime.

- MAT Rate Reduction

- Restricted Utilisation of Existing MAT Credit – Domestic Companies

- Existing MAT credit can be used only under the new regime for domestic companies.

- Set‑off is restricted to a maximum of 25% of tax liability for a given year.

- MAT Credit for Foreign Companies

- Carry Forward Period

- MAT credit continues to be carried forward for up to 15 years from the year it first arose; unutilised credit after this period lapses.

What This Means for Corporates in Delhi NCR

- Companies relying on large MAT credit balances must now assume slower utilisation due to the 25% cap per year and the shift towards the new regime.

- The system clearly nudges corporates to adopt the new regime rather than continue indefinitely under the old MAT‑heavy framework.

- Cash‑flow planning becomes critical for highly capital‑intensive or low‑margin entities that historically paid MAT.

Taxation of Buy‑Back of Shares – Capital Gains with Extra Tax for Promoters

Earlier Regime – Deemed Dividend Approach

Previously:

- Consideration received on buy‑back of shares or specified securities was treated as “dividend income” taxable as Income from Other Sources at slab rates in the hands of the shareholder.

- Cost of acquisition of the extinguished shares was separately treated as capital loss.

- This created an artificial bifurcation – income as dividend, but loss as capital, distorting the true capital nature of the transaction.

Budget 2026 – Capital Gains Framework

Finance Bill 2026 rationalises buy‑back taxation by shifting to a capital gains‑based regime.

Key features:

- Buy‑Back Proceeds Taxed as Capital Gains

- Buy‑back consideration now taxed as capital gains, with cost of acquisition allowed.

- The earlier deemed dividend provision stands withdrawn.

- Additional Tax on Promoters’ Gains

- Recognising the influence of promoters in buy‑back decisions, an additional income‑tax is levied on capital gains arising to promoters from buy‑backs.

- Promoters now pay: normal capital gains tax plus an additional tax at prescribed rates.

- Tax Treatment for Non‑Promoter Shareholders

- Non‑promoter shareholders are taxed only under capital gains; no additional levy applies.

Effective Tax Rates – Promoters vs Others

| Category | Capital Gains Tax | Additional Tax | Net Effective Tax |

|---|---|---|---|

| Promoter – Domestic Company (STCG) | 20% | 2% | ≈ 22% |

| Promoter – Domestic Company (LTCG) | 12.5% | 9.5% | ≈ 22% |

| Promoter – Other than Domestic Company (STCG) | 20% | 10% | ≈ 30% |

| Promoter – Other than Domestic Company (LTCG) | 12.5% | 17.5% | ≈ 30% |

For non‑promoter shareholders:

| Category | Capital Gains Tax | Additional Tax | Net Effective Tax |

|---|---|---|---|

| Normal shareholder (STCG) | 20% | 0 | ≈ 20% |

| Normal shareholder (LTCG) | 12.5% | 0 | ≈ 12.5% |

Policy Intent

- Align buy‑back taxation more closely with its capital nature.

- Provide a neutral regime for minority shareholders.

- Impose higher effective tax on promoters to discourage aggressive buy‑back‑driven value extraction.

Strategic Implications for NCR Corporates and Late‑Stage Startups

1. Rethinking Capital Allocation – Dividend vs Buy‑Back

Promoters and boards must now evaluate:

- Whether buy‑backs remain superior to dividends after factoring higher promoter‑level effective tax under the new framework.

- The impact on EPS, market signalling and promoter wealth compared to regular dividend policies.

2. MAT and Regime Choice

For corporates:

- Mapping MAT versus normal tax under the new regime is essential.

- Large MAT credit balances may argue for a calibrated shift to the new regime to enable utilisation within the 25% cap, while aligning with promoter distribution strategies (dividends or buy‑backs).

3. Transaction Timing and Structuring

Boards planning major buy‑backs should:

- Revisit programme size, timing and pricing in light of the revised tax outcomes for promoters and institutional investors.

- Consider alternate mechanisms such as special dividends, capital reduction schemes or rights buy‑backs in specific situations.

Table A: MAT Framework – Old vs. New (Post-April 1, 2026)

| Feature | Old System (Pre-2026) | New System (Budget 2026) |

| MAT Rate | 15% + Surcharge/Cess | 14% (Terminal Levy) |

| Tax Nature | Advance Tax / Adjustable Credit | Final Tax (No Fresh Credit) |

| Credit Accrual | Fresh Credit allowed for 15 years | Accumulation ceases 31-Mar-2026 |

| Old Credit Usage | Adjust against Normal Tax liability | Limited set-off (Max 1/4th of liability) |

| Regime Nudge | Balanced | Strongly nudges toward New Regime (22%) |

Table B: Share Buy-Back Taxation – Effective Rates

| Shareholder Category | Tax Treatment | Effective Rate (LTCG) |

| Minority / Retail | Capital Gains (Section 46A) | 12.5% (Exemption up to ₹1.25L) |

| Domestic Co. Promoter | Capital Gains + Additional Levy | 22% |

| Non-Corporate Promoter | Capital Gains + Additional Levy | 30% |

| Short-Term Holders | Capital Gains (STCG) | 20% (Listed) / Slab Rates |

FAQs – MAT and Buy‑Back Changes

1. Can we continue to accumulate MAT credit under the old regime?

No fresh MAT credit is proposed to be allowed under the old regime; MAT there becomes final tax. Existing credit is ring‑fenced and usable subject to new conditions.

2. How will existing MAT credit be used?

Domestic companies can set off existing MAT credit only under the new regime, and only up to 25% of the tax liability for that year. Any remaining credit carries forward, subject to the 15‑year time‑limit.

3. Are all buy‑backs now taxed at capital gains rates?

Yes, buy‑back proceeds are taxed as capital gains, with cost of acquisition recognised. For promoters, an additional tax applies; for other shareholders, only capital gains tax applies.

4. Does this change apply to past buy‑backs?

The amended regime applies prospectively as provided in the Finance Bill 2026. Past buy‑backs will continue to be governed by earlier law.

Call‑to‑Action

If you are a promoter, CFO or finance head of a company or scale‑up in Delhi NCR, these changes directly impact your capital allocation plans and tax cash‑flows. A “business as usual” approach to MAT, regime selection and buy‑backs can result in avoidable tax leakage.

Our corporate tax team can:

- Analyse your MAT credit profile and regime options

- Evaluate dividend vs buy‑back strategies under the new tax rules

- Design a capital distribution roadmap aligned with shareholder expectations and tax efficiency

To discuss your group’s MAT and buy‑back strategy, connect with us for a focused consultation.

Disclaimer

This blog is a general informational update based on the Finance Bill, 2026 and publicly available material and does not constitute professional or investment advice. Readers should obtain specific advice from their Chartered Accountant, tax consultant and legal counsel before making decisions on regime selection, capital structuring or buy‑backs.