MCA Update: Big Relief for Directors! Annual KYC Scrapped for Triennial Filing (G.S.R. 943(E))

MCA notifies triennial DIR-3 KYC filing. Learn compliance impact, applicability and relief for directors under GSR 943(E)

In a significant move to promote the “Ease of Doing Business” in India, the Ministry of Corporate Affairs (MCA) has overhauled the Director KYC framework. If you hold a Director Identification Number (DIN), the days of repetitive annual filings are over.

Vide Notification No. G.S.R. 943(E) dated December 31, 2025, the MCA has substituted Rule 12A of the Companies (Appointment and Qualification of Directors) Rules, 2014. This amendment fundamentally changes how directors maintain their compliance status.

As a Chartered Accountant firm serving the Delhi NCR region, we have analysed this notification to bring you the key takeaways, actionable insights, and what this means for your compliance calendar.

The Core Change: From Annual to Triennial Compliance

Previously, every individual holding a DIN was required to file the DIR-3 KYC form annually, regardless of whether their personal details had changed. This created a recurring compliance burden for directors and professionals alike.

Under the new Amended Rule 12A:

- New Frequency: The mandatory annual filing has been replaced with a Triennial (Once every 3 years) filing requirement.

- Effective Date: These changes come into force on March 31, 2026.

- The New Cycle: If you hold a DIN as of March 31st of a financial year, you are now required to file your KYC intimation on or before 30th June of the immediately following third financial year.

Key Takeaway: If your KYC is currently up to date, your next mandatory routine filing is likely pushed to June 30, 2028.

Implications for Businesses and Directors in Delhi NCR

This amendment is a breath of fresh air for the thousands of directors and corporate professionals in hubs like Gurugram, Noida, and Delhi. However, it comes with specific nuances that must not be ignored.

1. Reduced Compliance Cost & Effort

For directors serving on multiple boards or private limited companies in Delhi NCR, the administrative fatigue of confirming the same details every year is removed. This reduces professional fees and administrative downtime.

2. Stricter “Event-Based” Compliance

While the routine filing is now every three years, the MCA has tightened the noose on keeping data current.

- The 30-Day Rule: If there is ANY change in your personal details (Mobile Number, Email ID, or Residential Address), you must file Form DIR-3 KYC Web within 30 days of such change.

- The Trap: Many directors previously waited for the annual due date to update address changes. Doing so now could attract penalties or DIN deactivation, as you can no longer wait for the 3-year cycle to update changes.

3. DIN Reactivation Window

For directors who are currently non-compliant (DIN Deactivated), the notification provides a window until March 31, 2026, to reactivate their DINs under the existing provisions.

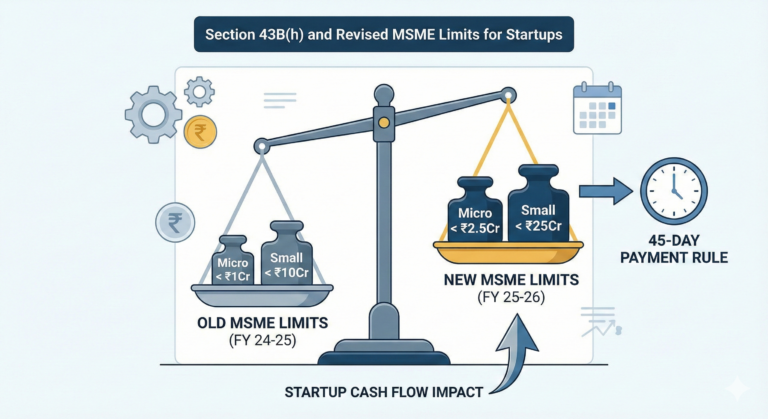

Comparison: Old Rule vs. New Rule

| Feature | Old Rule (Pre-Amendment) | New Rule (Amended Rule 12A) |

| Filing Frequency | Annually (Every Financial Year) | Triennially (Every 3 Years) |

| Due Date | September 30th of the immediate next FY | June 30th of the third following FY |

| Change in Details | Could often be updated during annual filing | Must be updated within 30 days of change |

| Form Used | DIR-3 KYC / DIR-3 KYC Web | DIR-3 KYC Web |

Scenario Analysis: How It Affects You

Scenario A: The Stable Director

Mr. Sharma, a director in a Noida-based manufacturing unit, has valid KYC as of March 31, 2025. He has no plans to move houses or change his number.

- Impact: Mr. Sharma does not need to file anything in 2026 or 2027. His next mandatory KYC filing is due by June 30, 2028.

Scenario B: The Relocating Director

Ms. Gupta, a startup founder in Gurugram, moves to a new apartment in South Delhi on August 10, 2026.

- Impact: Even though her triennial KYC is not due until 2028, she MUST file DIR-3 KYC Web by September 9, 2026 (within 30 days) to update her address. Ignoring this until 2028 is a violation.

Frequently Asked Questions (FAQs)

Q1: I just filed my KYC in September 2025. Do I need to file again in 2026?

No. If your DIN is active and compliant as of March 31, 2026, you automatically shift to the new triennial cycle.

Q2: What happens if I miss the 30-day window to update my address?

Failure to update changes within 30 days may lead to penalties or potential deactivation of your DIN, hindering your ability to sign documents or file returns for your company.

Q3: Is the filing fee different for the 3-year form?

The notification emphasizes using Form DIR-3 KYC Web. Standard government fees (or additional fees for delayed filing) as per the Companies (Registration Offices and Fees) Rules will apply.

Q4: Does this apply to Disqualified Directors?

The requirement applies to every individual who holds a DIN. Even if disqualified under Section 164(2), maintaining KYC status is often required to keep the DIN valid for future use.

Need Help with Director Compliance?

Navigating the transition from annual to triennial compliance can be tricky. Whether you need to reactivate a suspended DIN or file an immediate change of address, Kunal Kapoor & Associates is here to assist.

Contact us today for a compliance health check of your company’s Board of Directors.